If you believe the County’s valuation of your property is inaccurate, you have the right to appeal. Here’s what you need to know:

1. Start With an Informal Appeal

The first step is filing an informal appeal through the Johnston County Tax Administration Office. During this process, you can:

- Provide evidence. Such evidence includes a recent appraisal, discrepancies in square footage, and photos (including any structural issues or interior features).

- Request that the County reconsider your valuation.

Below are some valid reasons to appeal your assessed property value:

- The market value of your property is significantly higher or lower than the fair market value.

- The market value of your property is not equitably appraised compared to other similar properties.

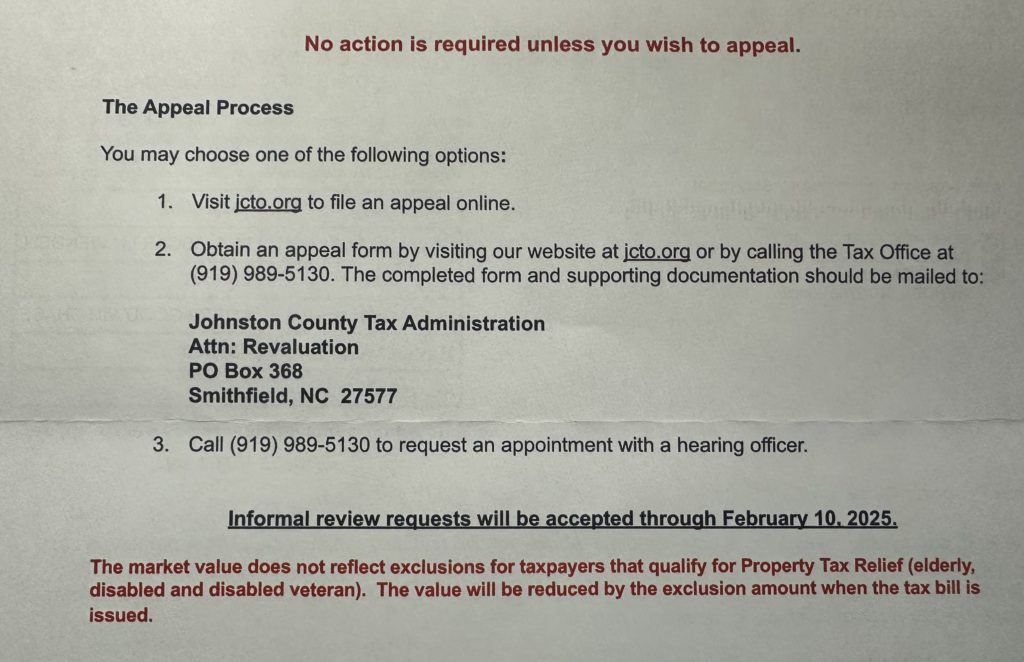

2. Three Methods to Appeal

There are three ways for someone to appeal a property value.

A. Online at jcto.org or johnstonnc.gov/tax Documentation can be uploaded and upon submission of the appeal, we will send a confirmation email that it was received.

B. By mail. Download the application from our website or call our office and we will mail a blank application.

C. In-person meeting with an appraiser. Schedule an appointment by calling 919-989-5130, the Reval option (0), then (2) to speak with an attendant who will schedule the appointment.

If a property owner wishes to speak with an appraiser before appealing, they should call 919-989-5130, the reval option (0), then (1) to speak with an appraiser. An appraiser will not provide a revised value in-person or on the phone. Decision of Value letters will be mailed in March.

3. If Denied, File a Formal Appeal

If your informal appeal is denied, you can escalate the process by filing a formal appeal with the Board of Equalization and Review (BOER). This step allows you to present your case, including:

- Recent sales data for comparable properties.

- Any additional documentation supporting your claim.

Having accurate data and the support of a knowledgeable Johnston County-based real estate agent is crucial for a successful appeal. The RiverWILD Real Estate Team can provide you with the most up-to-date market information and comps to strengthen your case.

3. Important Deadlines

The deadline for filing an informal appeal is February 10, 2025, at 5:00 PM. Don’t wait to act if you believe your valuation is incorrect!

Pro-Consumer Tips From The RiverWILD Real Estate Team

- Stay Informed: Understanding how revaluations work can help you feel more confident about the process.

- Partner With an Expert: Your Johnston County REALTOR® is your best resource for navigating appeals and understanding the current market value of your home.

- Ask Questions: If you have concerns, contact the Johnston County Tax Office at 919-989-5130 for assistance.

At RiverWILD Real Estate, we’re here to help you navigate this process and advocate for your best interests. If you have questions about your property valuation or need assistance with an appeal, don’t hesitate to reach out to us via email or by calling our team at (919) 813-0123. Together, let’s ensure you’re well-informed and well-prepared.