This is the #1 conversation happening quietly in buyers’ heads — and loudly at dinner tables:

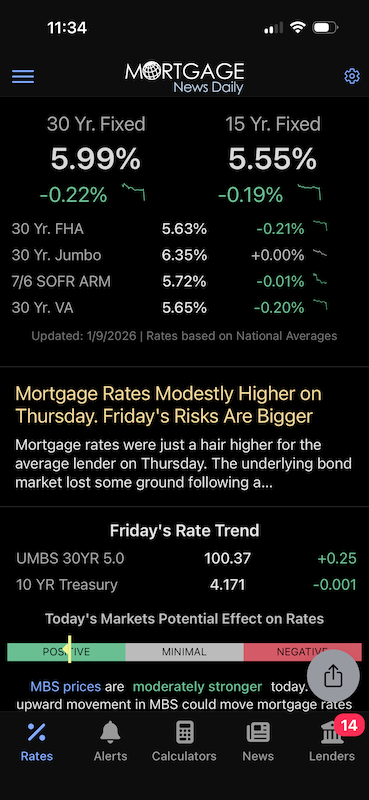

- Rates have dropped and are the lowest they have been in years

- Prices have softened or stabilized in many JoCo sub-markets

- Inventory is finally giving buyers choices

- Builder incentives are doing things rates alone can’t

- Buyers are scared of “getting it wrong”

Consumers don’t want predictions. Most of all… buyers want permission to move forward without regret.

An Honest, Local Answer for 2026 Johnston County Homebuyers

If you’re thinking about buying a home but keep asking yourself “Should I wait?” — you’re not alone.

This is the most common question buyers are wrestling with right now. And it’s a fair one. In the recent past, interest rates have been volatile. Prices have shifted. Headlines are noisy. Advice online is… conflicting at best.

Let’s slow this down and look at what actually matters — especially here in Johnston County and the surrounding Triangle market.

Why this Question Feels So Heavy Right Now

Buyers today are caught between two fears:

- 😟 “What if rates drop after I buy?”

- 😟 “What if prices rise again while I wait?”

Both are valid.

But neither should be answered with guesses or national headlines.

What’s Actually Happening in the Local Johnston County Real Estate Market?

Here’s what buyers are experiencing right now:

- More inventory → more choices and less panic, fewer multiple offers

- Stabilizing prices → fewer bidding wars than recent years

- Builder incentives → rate buy-downs, closing cost help, creative solutions to break a (RW) lease

- Rates lower than recent peaks → not 3% as in 2021, but vastly improved from 8%

- Lower due diligence fees and builder deposits recent peaks → less money upfront

This combination is rare — and it matters more than trying to time the exact bottom of interest rates.

5-Star Review from a Happy Homeowner Who Made a Decision to Buy

Our home hunting journey began during the pandemic crazy times. During that time we made several offers but got outbid on all of them. We decided to take a pause on home hunting till this past year came around. Our rental lease was coming to an end in July so we decided to revisit the idea of buying a home again. From the start, Megan considered our needs and wants. After putting in an offer, we were a bit hesitant, since we’ve heard how overwhelming the process of buying a home could be, but let me tell you, Megan and her husband, our lender, made the process so easy and enjoyable for us.

Manuel and Gissella

The Mistake Many Buyers Make: Focusing Only on Rates

Rates matter — but they’re not the whole story. Say it again…

What buyers often overlook:

- You can refinance a rate

- You can’t renegotiate the purchase price later

- You can’t get today’s incentives once demand heats up

- Inventory may lessen once buyers return to the market – that means less choice

In many cases, buyers who wait for a lower rate end up:

- Paying more for the home

- Facing more competition

- Losing leverage with sellers and builders

When Waiting does Make Sense

Waiting may be the right move if:

- You’re working on your credit

- You’re working on your job stability

- You don’t plan to stay in the home long

- You’re unsure about your monthly comfort zone

- You simply need more clarity and education (Let’s chat)

- You’re life circumstances will be changing in a year or so (getting married, having a baby, relocating next year)

Waiting isn’t wrong. Waiting without a plan is.

When Buying Now Quietly Works in Your Favor

Buying now often makes sense when:

- You find a home that fits your life and budget

- Builder incentives meaningfully lower your payment

- You plan to refinance when rates improve

- You want choice, leverage, and less competition

- A life event has occurred (just had a baby, just got married, relocated to be near family, relocated with a new job)

Smart buyers aren’t trying to “win the market.”They’re protecting their monthly payment and long-term flexibility.

The Real Question Buyers Should be Asking

Instead of:

“Should I buy now or wait?”

A better question is:

“What does buying now vs waiting look like for me, based on real numbers?”

That answer is different for every buyer — and it can’t be found in a headline or even a quick explanation. Don’t be afraid to look deeper.

A Simple Next Step (no pressure)

If you’re on the fence, the smartest move isn’t rushing — it’s getting clarity.

A short conversation with a REALTOR® can help you:

- Compare buy-now vs wait scenarios

- Understand incentives that may not last

- Decide confidently — either way

Whether your move is now or later, the goal is the same: make it with confidence, not fear.