By The RiverWILD Real Estate Team with Hometowne Realty

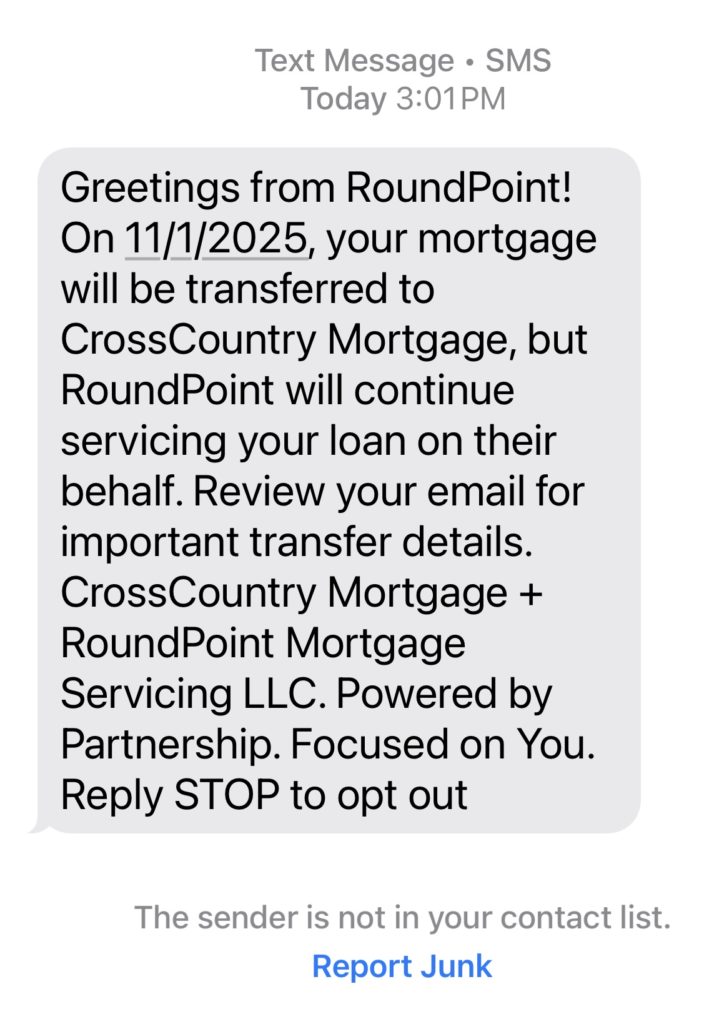

Have you received a text (like the one below) or email from your mortgage company saying your loan servicing will be transferred?

Breathe deep — this happens more than you’d think. In fact, loans are bought, sold, and transferred all the time. We’ve even seen our client’s loan transferred within months of buying their new home.

The good news? In most cases, your loan terms do not change — not your rate, not your balance, not your monthly payment.

Here’s how to handle it like a pro homeowner:

Your Step-by-Step Guide

1️⃣ Watch for the official letter

Federal law requires both mortgage servicers to notify you in writing. Save those notices for your records.

2️⃣ Keep paying the same way… for now

Don’t switch online portals or mailing addresses until the written notice tells you to. Within the first 60 days of a transfer, you are protected from late fees or credit hits if a payment accidentally goes to the previous servicer.

Under federal law (specifically Real Estate Settlement Procedures Act (RESPA) and its implementing regulation) when your loan servicing is transferred to a new servicer, you are protected for a 60-day period (starting from the effective date of the servicing transfer) in the sense that payments you make to the old servicer (rather than the new one) will not be treated as late for the purposes of charging late fees or reporting a delinquency to credit bureaus.

Consumer Financial Protection Bureau

3️⃣ Verify everything directly with the servicer

Before updating auto-pay:

✔️ Confirm payment details

✔️ Compare loan numbers

✔️ Store copies of the transfer notices

4️⃣ Watch your escrow

Your escrow account should transfer as-is:

- Property taxes ✔️

- Homeowners insurance ✔️

- Flood insurance (if applicable) ✔️

It’s smart to check your next tax statement and insurance declaration page just to be sure the correct loan servicer is listed.

5️⃣ Watch for scams!

If something looks suspicious — it probably is.

Never click unknown payment links from texts.

Quick Checklist

- Wait for official mailed notice

- Verify new servicer details

- Update auto-draft only after confirming transfer

- Keep statements and transfer letters

- Confirm escrow + insurance status

The RiverWILD Real Estate Team Is Here to Help

If you’re unsure whether a notice is legitimate or need help navigating the transfer, call your expert RiverWILD agent anytime. You deserve confidence — and a REALTOR® that’s always on your side in every step of your homeownership journey.

Need help? Connect with one of our local Johnston County real estate experts at RiverWILDRealEstate.com.